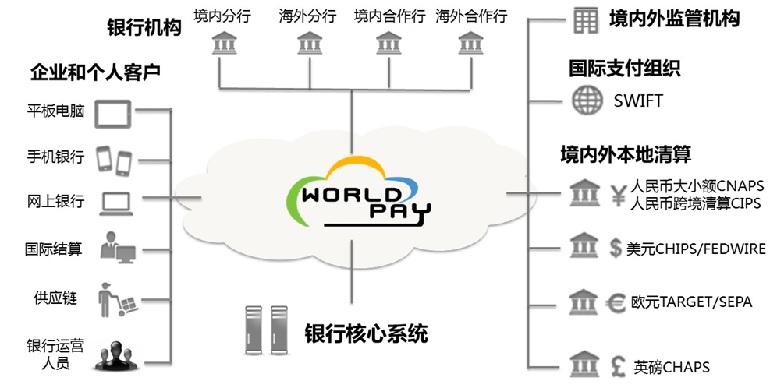

Eig pays is the international payment product of Eigpay Company. It is based on the experience accumulation and sublimation of the Eigpay payment team to build domestic and overseas payment systems for many years, combined with the development trend of the industry and the best practice of various payment system construction, after independent research and development. With innovation and meticulously created an international payment platform that is perfectly suited to domestic and foreign bank customers.Eig pays support for docking size and super online banking system, CIPS cross-border RMB, domestic and foreign currency system and SWIFT, while supporting large euro area TARGET2 and small batch SEPA, US dollar clearing system such as FEDWire, UK BACS/ FASTPAYMENT/CHAPS and other Australian dollar clearing systems such as DE/PDS in Australia, and more than 30 mainstream regional clearing systems in the world, can truly support the unified management and business innovation of bank customers.Eigpays has a strong system integration capability, based on standardized payment processes, and quickly accesses various clearing systems. The processing of each clearing system is centralized in a unified payment system, avoiding the new access to a new clearing system. The traditional mode of a system can truly unify business processes, unify business operations, simplify manual operations, and greatly improve the automatic processing level of local and foreign currency integration of bank customers.

Provides industry-standard end-to-end payment processing services that support highly straight-through processing;Provide a stable and reliable process engine to quickly customize the payment processing process according to the actual needs of bank customers;Provide a stable and reliable rules engine to quickly support cross-national cross-currency business development and innovation, simply complete the simple business configuration without the need to modify the code on a large scale to meet the business needs of different domestic and overseas branches;A unique rules engine-based system that greatly enhances the creativity of business processes;Using a low-coupling integrated architecture, the payment platform is well-expanded through the integration of SOA.

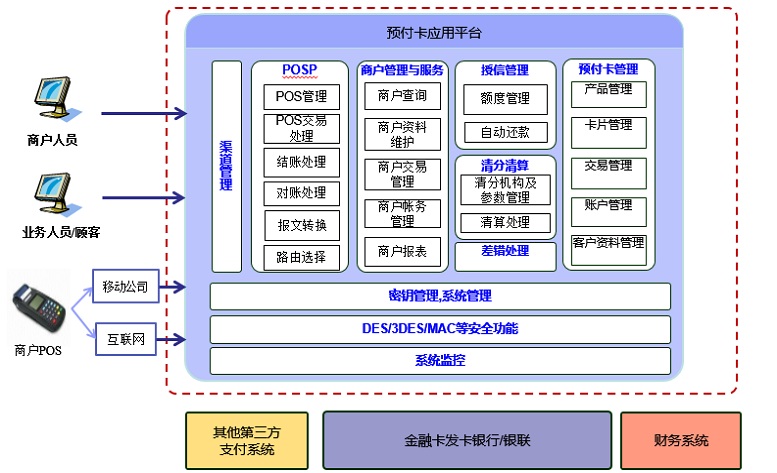

In the current society, whether in the financial or non-financial system, there are a large number of prepaid card services, such as: food court catering cards, cinema viewing cards, shopping cards, traffic cards and various small gift cards issued by banks, commemorating Card and so on.

Domestic financial and non-financial prepaid cards have clear management systems and regulatory agencies. Based on years of financial payment, account, exchange and card business capabilities, Renju Huitong has launched its own prepaid card management system in accordance with regulatory requirements and industry characteristics. It can be combined with Renju Huitong's payment and account platform to provide services. Interfacing with other accounting systems within the company.

Through the prepaid card system, a POS+ prepaid card is used as a financial payment tool to create a “closed loop” financial network.

Prepaid cards can support: settlement cards and consumer cards. The settlement card is mainly used for merchant settlement. The main body of the issuance is: the merchant unit; the consumer card is mainly used for individuals and groups. The prepaid card system can be extended to support debit cards for financial companies, as well as for specific card issuance services for non-financial institutions.

Eigpay prepaid card system has the following characteristics:

• Can define multiple types of accounts and complete the corresponding management and settlement requirements, including: basic accounts, special accounts, temporary account.• The system opens a basic account as the main payment account, which can be associated with several sub-accounts for different applications.• Support for multi-level architecture, including: headquarters, sub-centers, storefronts, etc.• System parameterization and flexible configuration, can support: transaction check, routing rules, account check, risk control, expense rules, transaction notification, etc.• Provides real-time, near real-time clearing, including: data clearing, fund transfer, reconciliation, and error handling• Connect with third parties through standard interface protocols to support ISO8583, XML financial messages, etc.• In addition, it provides monitoring and analysis capabilities for suspicious, blacklist, and anti-fraud• Suspicious according to the customer's business volume, size and characteristics of the transaction, optional stand-alone version, distributed architecture infrastructure• At the basic level, sufficient security technologies are provided for data security, application security, network security, and information security.

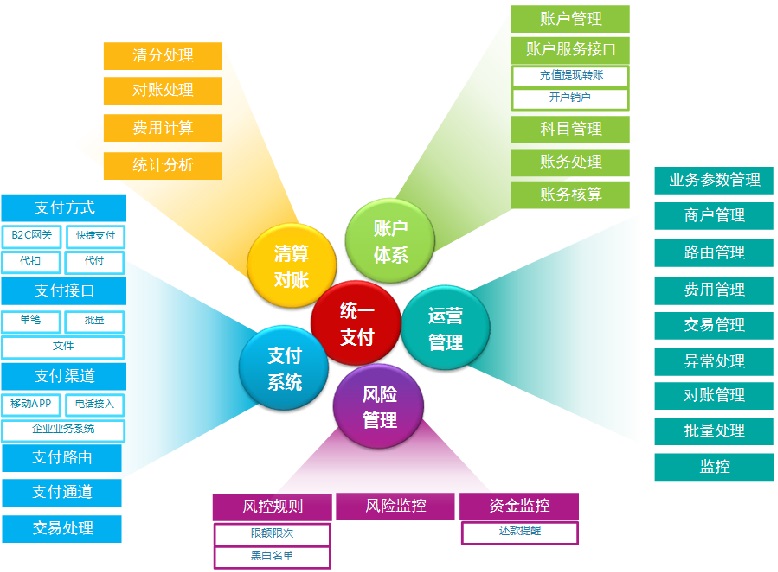

In the era of mobile Internet, building an enterprise-level payment center is necessary for enterprise strategic transformation and business innovation.The unified payment and settlement platform of enterprises mainly provides payment and settlement services of electronic currency for enterprises.

By integrating payment channels and realizing unified payment processing of multi-channel access, the platform can be widely used in enterprises' daily production, operation, marketing, after-sales and other links involving fund allocation, payment and settlement.

Through the construction of unified payment platform, to achieve integration of multiple business system inside the enterprise, will be scattered in various business system of online trading systems, such as net silver gateway, fast payment and centralized clearing platform for processing, payment platform, can provide a variety of means of payment, such as online payment, mobile payment and other payment, will eventually form a unified external and internal interfaces, with Banks and third-party payment, payment gateway connection, and the company internal each system provides a single interface, and implement with financial institutions and companies of the internal settlement and reconciliation.

Architecture design supports cloud mode, architecture is extensible, configurable, scalable, and isolated;

Uniform message specifications;

Intelligent routing is built in, and the optimal routing payment is selected according to different business rules.

Integrate multiple third-party payment platforms to provide users with more choices.

Supply chain finance refers to the portfolio financing derived from the accounts receivable, accounts payable, prepaid and inventory financing under the commodity transaction of the enterprise.

Supply chain finance takes core enterprises as the entry point, through the effective control of information flow, logistics and capital flow or the binding of responsibilities to related parties of strength, to provide financing services for suppliers and distributors with long-term cooperation in the upper and lower reaches of core enterprises

The structured nature of supply chain finance aims to compensate for borrowers' lower credit ratings.The risk is mainly reflected in the degree of self-liquidating of financing and the lender's ability to structure the transaction, rather than the borrower's own credit rating.

By virtue of Eigpay supply chain financing solution, financing institutions can help manufacturers upstream and downstream of the supply chain to conduct fast financing from orders to cash, thus promoting business development of manufacturers and business development of financing service providers

We have agency payment financing solutions, bidding type buyer discount solutions, factoring financing solutions, pre-payment supervision and pledge financing solutions for B2B platforms. These mature supply chain financial products can help enterprises achieve early rapid business introduction.

1. Support of multiple modes: support receivables mode and coping mode;2. Multi-process support: support the purchaser process and supplier process;3. Integrated services of order, capital and other information;4. Integration of supply chain financing services;5. Risk monitoring and prevention: through risk identification, risk measurement, risk control and risk treatment, the limitation includes eight kinds of risks, including credit risk, collateral management risk, etc., to ensure the consistency, comprehensiveness, independence and effectiveness of financing treatment

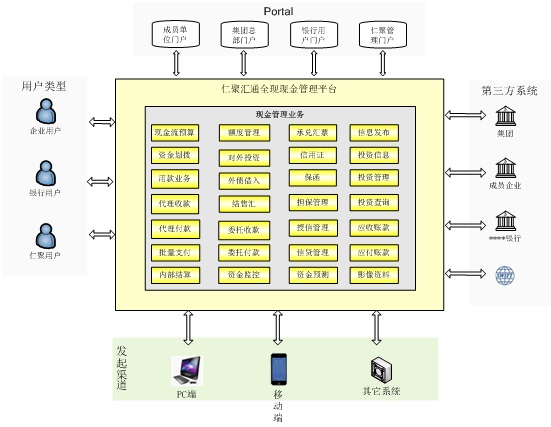

Eigpay global cash management platform mainly manages all kinds of enterprise cash business through unified management of RMB and foreign exchange cash pools in and out of enterprise groups.Global cash pools include: integrated RMB cash pools at home and abroad, domestic foreign currency cash pools and overseas foreign currency cash pools, and connect all kinds of cash pools to conduct centralized and unified operation and management of global cash pools.The overall structure of Eigpay global cash management platform products is as follows:

The platform will cooperate with Banks, SWIFT organization and third-party payment company to complete the construction of global cash management system

Features of Eigpay global cash management platform:(1) the product can be deployed in a public cloud or a private cloud of customers to meet the system deployment and management operation and maintenance requirements of different customers to the maximum extent.(2) the products will comprehensively solve the RMB and foreign exchange funds of customers both at home and abroad, enabling customers to obtain one-stop global cash management services.(3) by introducing the cash flow budget management function, the product can plan, control and analyze the cash flow of customers in advance.Understand the change of cash through cash monitoring in real time;Realize effective cash flow forecast by combining the management of accounts receivable and accounts payable businesses.(4) through the management of customer investment and financing business, the responsible person of the client can fully grasp the capital inflow and outflow situation of different investment and financing businesses in different periods, and provide the basis for the business decision-making of the responsible person of the client.(5) in order to effectively meet the personalized needs of customers, the system can provide the relevant query statistics, bank and enterprise reconciliation, account transfer and other personalized functions according to customer requirements, which can well solve the differentiated management problems of customers

On August 31, 2015, the general office of the state council issued the guidance on accelerating the development of the financial leasing industry, which first mentioned the industry development goal. According to the global leasing report, the penetration rate of the leasing market in developed countries in Europe and America is usually 15-30%.At the end of 2013, China's rental market penetration rate was only 3.1%.Penetration in the industry was 5.14% in 2014, well below the level of developed countries.

According to data from the ministry of commerce, in 2014, China's financial leasing enterprises invested 537.41 billion yuan in financial leasing, 151.06 billion yuan more than the previous year, an increase of 39.1 percent.Total industry contract balance at the end of 2015 was 4.44 trillion yuan, up 39 percent year-on-year.China's rental business volume in 2013 was $88.9 billion, a 4.1 times increase over the five years since 2008, with an average compound growth rate of 32.4%.If the industry maintains a growth rate of 30% and fixed asset investment increases by 10%, the penetration rate of the industry can reach 10% in the next five years.

The future development of the leasing industry is very promising, but at present, the development of the financial leasing industry is still disorderly due to the large market cake, which has low barriers and disorderly competition.In the future, the industry is bound to enter the stage of integration. The innovation of business and profit model enables a group of excellent enterprises to truly gain their own market and enter the stage of high growth and high profit.

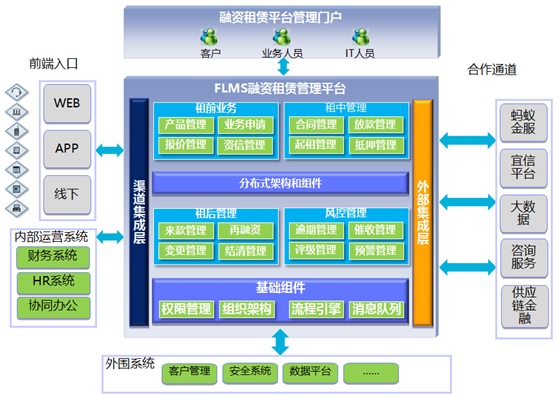

Eigpay financial leasing management plan helps finance leasing companies to build an efficient core management platform and risk control system of the whole process by combining IT consulting and IT services, so as to provide complete, efficient and end-to-end business integration solutions for finance leasing companies

Data management centralization: to achieve large data centralization of finance leasing companies, business collaboration, resource, process, capital integration, information sharing, convenient management and inquiry, and leading business decisions;

Business process standardization: realize the automatic process processing of the whole life cycle of financial leasing business, which runs through all the stages before, during and after the lease of the project;

Extensive use: it can exchange business data with surrounding business upstream and downstream, support mobile office, send messages to customers by SMS and email on a regular basis, and improve operational efficiency

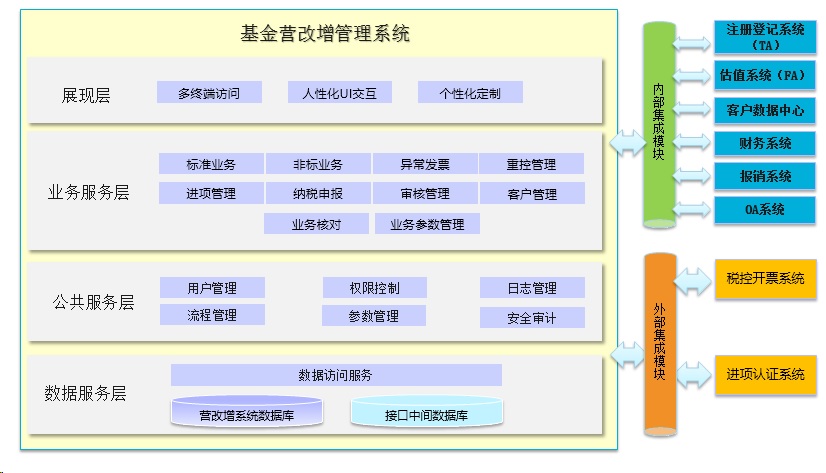

At the fourth session of the 12th National People's Congress (NPC), premier li keqiang pointed out that the reform of the business tax to value-added tax has been fully implemented, and the pilot scope will be extended to construction, real estate, financial and life service industries from May 1, 2016.This marks that the reform of business tax to VAT in the financial industry has entered the sprint phase, and the reform of business tax to VAT has only taken 2 months.The state tax authorities carry out highly information-based management of value-added tax. After replacing the business tax with a value-added tax, the company's income and expenditure shall be subject to price and tax separation, and shall issue VAT special invoices or general invoices to customers in strict accordance with the tax law.At the same time, the VAT invoice is required to manage the input tax.The VAT calculation and reporting management compliance requirements are also higher.Based on the above background, Beijing Eigpay information technology co., LTD., as an IT company specializing in providing financial informatization services, has developed a value-added tax management platform, which is mainly applicable to the financial industry and focuses on the fund field

Product solution: the overall architecture of our management system of replacing business tax with value-added tax follows the design concept of SOA, maintains loose coupling integration with peripheral systems, and can provide standard services to external parties, dividing the whole system into four levels.Each layer is relatively independent and connected to each other through the interface module of general technical standards to reduce the degree of coupling of all functional parts of the system and increase the flexibility of the whole system.The design of layered architecture can improve the universality and expansibility of the system and lay a good foundation for future flexible business changes.At the same time, it also provides the technical guarantee for the construction and improvement of the whole system step by step.As the l presentation layer adopts the idea of SOA for the overall architecture design, the presentation layer can achieve multi-terminal support (such as smart phone, tablet computer, PC, etc.), and the UI design can draw on the advanced Internet design experience to support personalized customization.Show layer will provide strict authentication and authorization mechanism, combining with public service layer provides access control service, ensure that all users to access to legitimate users, can through the USB KEY and RSA Token, etc to strengthen the user identity authentication to ensure system of screening, according to the definition of the role authorization, users of the system functions, data access control, service resource, etc.L business service layer business service layer is the core layer of the system, mainly service-oriented core business functions to provide flexible composite calls to the presentation layer and integration platform to meet business requirements from different business perspectives.The core functions of the business service layer mainly include: • standard business: accounting preparation, price and tax accounting, automatic billing, invoice printing, billing inquiry, and financial vouchers;• non-bid business: including contract management, invoice proceeds, price and tax accounting, invoice application, invoice printing, invoice inquiry, and financial vouchers;Abnormal invoice: including cancellation of make out an invoice, reopen invoice, red invoice, weight control management: including the purchase of the invoice, the invoice, invoice query input inventory management: including invoice certification, invoice listing, data checking, tax returns, including value-added tax returns, the current sales detail at current period, the input tax detail, tax deduction table, fixed assets touched buckle;Audit management: including audit, invalid audit, red audit of make out an invoice, customer management, including customer basic information management, customer mapping management, business management, customer preference check: including check, financial vouchers to check business parameters of make out an invoice management: including tax allocation of information of make out an invoice, the invoice amount of configuration As the change of business model, the expansion of business scale, business service layer can achieve flexible extension, meet the demand of the development of the business.L public service layer public service layer mainly provides some basic services, such as operation user management, permission control, log management, security audit, parameter management, security audit and basic process configuration management services of the platform, providing more powerful basic service support for business services.The data access layer of l data access layer extracts the access service of data independently, which is convenient for expansion, maintenance and management.Data interaction with other business systems can be carried out by means of intermediate library. Data access layer can shield the difference of interface intermediate database to avoid impact on core business services.The integration module mainly deals with the integration of the business tax reform system, internal business system and external tax system.Considering the differences in technology and implementation architecture between the system of replacing business tax with value-added tax and other systems that need to be integrated, the differences are referred to the integration platform for centralized processing by extracting the integration modules to adapt and connect different systems, shielding the differences in the dependence and technology realization between the system of replacing business tax with value-added tax and other systems.Integration module is divided into internal and external, its architecture design idea is consistent, the main difference is in the deployment structure, the internal integration module is responsible for internal system, the integration between the walk is the independence of internal network, higher performance requirement, security requirement is not so strict, and the external integration could go public, must guarantee the security, typically deployed in the DMZ area, at the same time, the transmission encryption methods, step-by-step to increase system provides a safety barrier, to block illegal external access, prevent data leaks and been tampered with.When the access system grows with business expansion, the integrated platform can also handle the access of these new systems more conveniently and flexibly.Client list: at present, it has been installed and debugged with Wells Fargo fund. In addition, it is in the process of program negotiation and technical discussion with several fund companies of Beijing, Shanghai and Guangzhou

On September 1, 2015, the General Office of the State Council issued the “Guiding Opinions on Promoting the Healthy Development of the Financial Leasing Industry”. It is proposed to fully understand the important role of financial leasing services in the real economy, and to put financial leasing in the overall strategy of national economic development.

In the economic downturn, the lessee's cash flow is tight, and the leasing company faces a large credit risk, which is reflected in the report is the increase in the non-performing asset ratio.

The increase in the non-performing rate has an impact on the income statement and the balance sheet, with the former affecting asset impairment losses and the latter changing liquidity exposure by affecting receivable financing loans.

According to the data of the China Banking Regulatory Commission, the ratio of non-performing assets of financial leasing companies in 2014 was 0.71%. In the context of macroeconomic downturn and risk accumulation, risk control has become an important means to ensure the profit quality of the company.

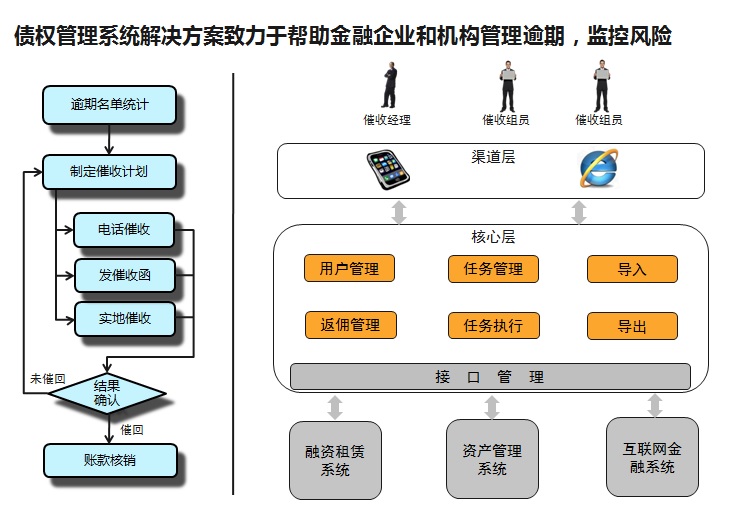

Facing the situation that the financial industry's contract balance over the trillions and the ratio of non-performing assets gradually increased, Eigpay designed and developed a financial leasing credit management platform to help financial leasing companies build efficient and comprehensive loans through mobile internet and risk management platform. After the wind control system.

Mobility: Realize the mobile office of the financial leasing company after the loan, realize the collection business synergy, process integration, information sharing, convenient management and query and lead business decision;Standardization: The full lifecycle management of the collection business after the financing lease loan is realized, which runs through the stages of task generation, assignment, submission, review and completion;Flexibility: Products can be deployed on public clouds or on customers' private clouds to maximize system deployment and management and operation requirements for different customers;System construction: Through the management of the business, establish a sound risk control system, manage the risks hierarchically, manage the lessees, ensure the leaseholds are controllable, and facilitate the customers to conduct risk assessment and decision-making;Report statistics: to achieve a large concentration of risk control data, the system can provide personalized functions such as big data query, analysis and reconciliation according to customer requirements;

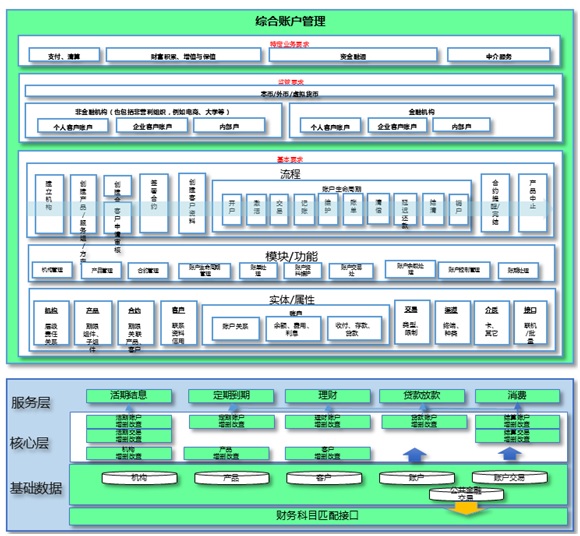

Comprehensive account solution Eigpay comprehensive account system supports all kinds of electronic accounts, the system is rigorous and flexible.In addition to supporting the traditional currency field, it is also applied to various business processing in the non-traditional currency field such as game coin, virtual coin, bonus, red card, point card and precious metal transaction.With the development of domestic economy and economic globalization, people's demands for financial business are constantly increasing.In this form, traditional financial institutions need to reconstruct the new account system to cope with the new and diversified demands, such as supporting the central bank's three types of electronic accounts, developing technologies related to bitcoin, and providing Internet processing supporting points and red packets.In addition, the rapid development of the economy highlights the deficiencies of domestic financial institutions and businesses, and objectively prompts more non-financial enterprises to start financial business. The account system is the primary consideration for them to conduct financial business.In addition, the development of new network technologies and low-cost open architecture also induces various innovations in the financial market. All these business innovations require more rigorous, compliant, safe and flexible accounting system to provide support

Eigpay account system provides rich accounting processing functions. Based on SOA architecture, it can be extended flexibly:• support multi-tiered account systems, such as group, family business• supports pricing processes for multiple financial products, such as interest rate, exchange rate, tax rate, rate, exchange rate• complete account life cycle management: account opening, freezing/thawing, account closing, etc• account data maintenance: term maintenance, property maintenance, customer contract maintenance• various financial transaction processing: consumption, transfer, recharge, withdraw, etc• account balance processing: balance freezing, balance adjustment, etc• real-time, quasi-real-time, batch business transactions: real-time transactions: for example, inquiry, consumption, recharge and transfer services within the real account system;Quasi-real-time transactions: for example, inter-agency transfers (which need to go through intermediate finance, banking or third-party payment systems and are affected by the transfer efficiency of relevant systems);Batch business: for example, batch withholding, etc• account control processing: usage rate control, channel control, front and back system linkage• billing: provide billing generation, query, and history processing for specific customers• account query: including financial and non-financial information, including balance query, detail query, platform business query, etc• cycling-deposit/cycling-withdraw business: specifically refers to the synchronous business of the balance and details of the same set of accounts in the cloud mode• cloud consumption and transfer: support cross-cloud and cross-institutional payment services• shadow account management: account opening, freezing/thawing, account closing, etc• virtual account management: provide credits, increase and freeze management of virtual currency accounts• clearing account management: settlement account processing between cross-agencies or cross-cloud business entities• supporting accounting check mechanism: periodic check, total score check, trial balance, various reconciliation handling, etc• support accounting error handling: billing, bilateral adjustment, etc• high level security management of the account, standardize the management of account atomic property design, extension and reuse