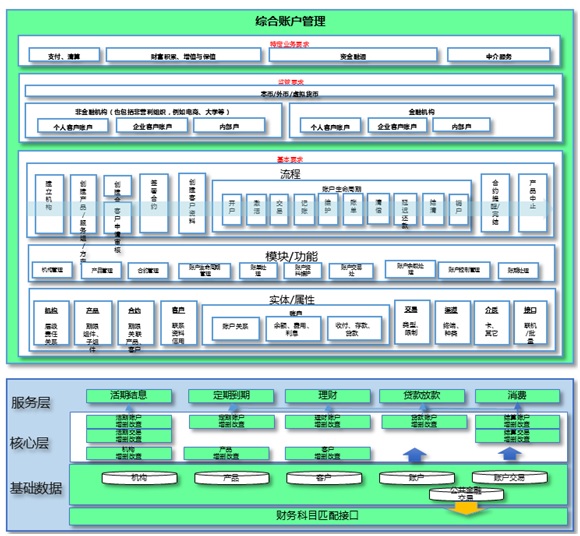

Comprehensive account solution Eigpay comprehensive account system supports all kinds of electronic accounts, the system is rigorous and flexible.In addition to supporting the traditional currency field, it is also applied to various business processing in the non-traditional currency field such as game coin, virtual coin, bonus, red card, point card and precious metal transaction.With the development of domestic economy and economic globalization, people's demands for financial business are constantly increasing.In this form, traditional financial institutions need to reconstruct the new account system to cope with the new and diversified demands, such as supporting the central bank's three types of electronic accounts, developing technologies related to bitcoin, and providing Internet processing supporting points and red packets.In addition, the rapid development of the economy highlights the deficiencies of domestic financial institutions and businesses, and objectively prompts more non-financial enterprises to start financial business. The account system is the primary consideration for them to conduct financial business.In addition, the development of new network technologies and low-cost open architecture also induces various innovations in the financial market. All these business innovations require more rigorous, compliant, safe and flexible accounting system to provide support

Eigpay account system provides rich accounting processing functions. Based on SOA architecture, it can be extended flexibly:• support multi-tiered account systems, such as group, family business• supports pricing processes for multiple financial products, such as interest rate, exchange rate, tax rate, rate, exchange rate• complete account life cycle management: account opening, freezing/thawing, account closing, etc• account data maintenance: term maintenance, property maintenance, customer contract maintenance• various financial transaction processing: consumption, transfer, recharge, withdraw, etc• account balance processing: balance freezing, balance adjustment, etc• real-time, quasi-real-time, batch business transactions: real-time transactions: for example, inquiry, consumption, recharge and transfer services within the real account system;Quasi-real-time transactions: for example, inter-agency transfers (which need to go through intermediate finance, banking or third-party payment systems and are affected by the transfer efficiency of relevant systems);Batch business: for example, batch withholding, etc• account control processing: usage rate control, channel control, front and back system linkage• billing: provide billing generation, query, and history processing for specific customers• account query: including financial and non-financial information, including balance query, detail query, platform business query, etc• cycling-deposit/cycling-withdraw business: specifically refers to the synchronous business of the balance and details of the same set of accounts in the cloud mode• cloud consumption and transfer: support cross-cloud and cross-institutional payment services• shadow account management: account opening, freezing/thawing, account closing, etc• virtual account management: provide credits, increase and freeze management of virtual currency accounts• clearing account management: settlement account processing between cross-agencies or cross-cloud business entities• supporting accounting check mechanism: periodic check, total score check, trial balance, various reconciliation handling, etc• support accounting error handling: billing, bilateral adjustment, etc• high level security management of the account, standardize the management of account atomic property design, extension and reuse